Are you a homeowner in sunny San Diego feeling the pinch of high mortgage payments? A refinance could be your ticket to significant financial freedom. With current market trends, now is a prime moment to explore your options and potentially lower your monthly payments.

- Mortgage specialists in San Diego understand the unique needs of homeowners in our area. They can help you understand the best refinance solution for your situation.

- Don't miss out. Contact a reputable lender today to get started on the path to a more manageable mortgage.

Slash Your Monthly Payments with a San Diego Refinance

Are you struggling by your current mortgage payments? A San Diego refinance could be the solution you need to lower your more info monthly costs and save cash flow. By adjusting your loan terms, you can potentially achieve a lower interest rate and shorten your repayment period, resulting in significant savings over the life of your loan.

With a variety of refinance options available in San Diego, you can tailor a plan that meets your specific financial needs and goals. Contact a qualified mortgage lender today to investigate how a San Diego refinance can help you in realizing your homeownership dreams.

Grab the Best San Diego Refinance Rates

Are you a homeowner in sunny San Diego looking to save your monthly mortgage payments? Refinancing your home loan could be the optimal solution for you. With competitive interest rates currently available, now is a great time to explore your refinancing possibilities. Our team of experienced mortgage professionals can help you explore the complex world of refinancing and find the best rate possible for your needs.

Don't get stuck with a high interest rate! Speak with to us today for a free, no-obligation quote and uncover how much you could reduce. We're dedicated to helping San Diego homeowners achieve their financial goals.

- Why should I refinance?

Embarking on Expert San Diego Home Refinancing Guidance

Refinancing your home in San Diego can be a complex journey. To guarantee you obtain the most favorable terms, it's vital to seek advice experienced professionals. San Diego is famous for its bustling real estate scene. Utilizing the expertise of a qualified mortgage advisor can significantly affect your loan modification.

A knowledgeable specialist will carefully review your economic circumstances and counsel you across the complexities of various refinancing possibilities. They will negotiate on your behalf to secure favorable interest rates.

Additionally, a proficient broker will make certain that you comprehend the provisions of your loan modification. They will illuminate any questions and provide you with intelligible information.

Finally, choosing an experienced San Diego home refinancing professional can preserve you time, anxiety and capital.

Best Mortgage Refinancing for SD Residents

Are you a San Diego homeowner looking to save money on your mortgage? Refinancing your existing mortgage could be the perfect answer for you. The mortgage rates in San Diego are attractive, making it an perfect opportunity to evaluate your current financial situation.

- Several loan types are accessible to San Diego homeowners, allowing you to pick the best option for your needs.

- Regardless of you want to shorten your loan term, there's a loan option designed to assist you.

Contacting a experienced financial advisor is the first step in understanding the most suitable refinance products for your unique situation.

Unlock Equity with a San Diego Cash-Out Refinance

Are you searching to boost your financial situation? A cash-out refinance in San Diego could be the optimal solution. By tapping into your residence' existing equity, you can access a lump sum of money to fund your aspirations. Whether it's paying off debt, making {homeupgrades, or putting in your future, a cash-out refinance can provide the flexibility you need.

Speak with our experienced team of mortgage professionals today to understand how a cash-out refinance in San Diego can help you tap into your equity and achieve your professional objectives.

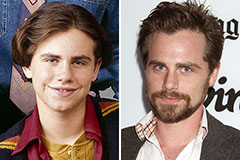

Rider Strong Then & Now!

Rider Strong Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!